INVESTMENT PROCESS

INVESTMENT STYLE

Knight Asia’s key investment style includes a combination of the following:

Market Trading

Momentum on value: Long/Short investing in liquid stocks for short-term gains.

Focused Value Investing

Aiming for medium-term performance through investing in undervalued stocks or shorting overvalued shares.

Strategic Investing

Investing strategically in a narrow group of companies for long-term performance, friendly activist.

Stock Selection

Stock selection for both long and short positions is determined by a matrix of parameters including quantitative ratios and valuations such as price-to-adjusted net asset value, price-to-book value, price-to-earnings per share (PE), PE to earnings per share growth, discounted cash flow valuation, and dividend yield. Stocks are also selected on qualitative factors such as assessment of management competence, direction, and integrity. The Manager pays close attention to market sentiment and may trade in and out of any position to capitalize on price fluctuations.

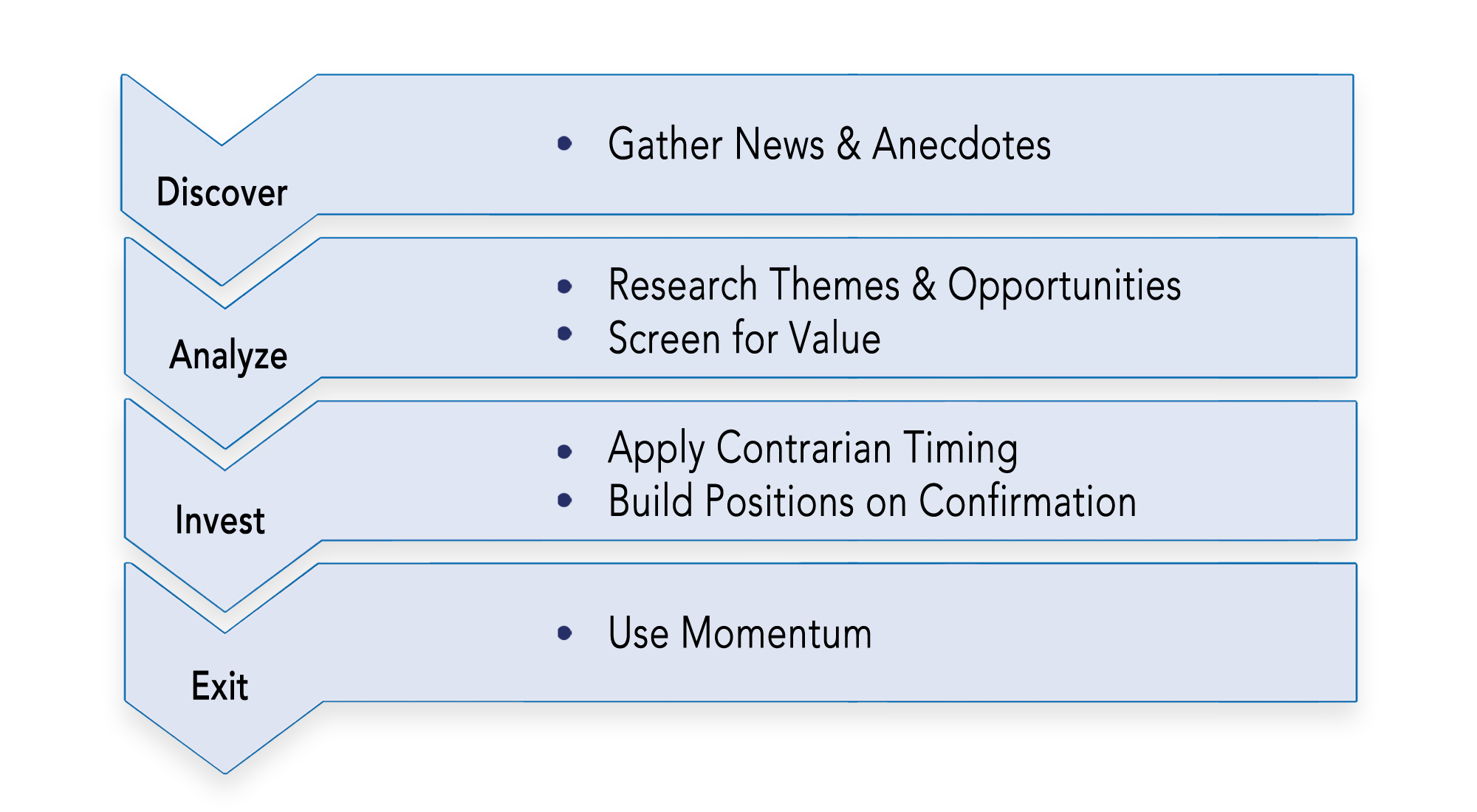

OVERALL INVESTMENT PROCESS